Homeowners Insurance in and around San Antonio

If walls could talk, San Antonio, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

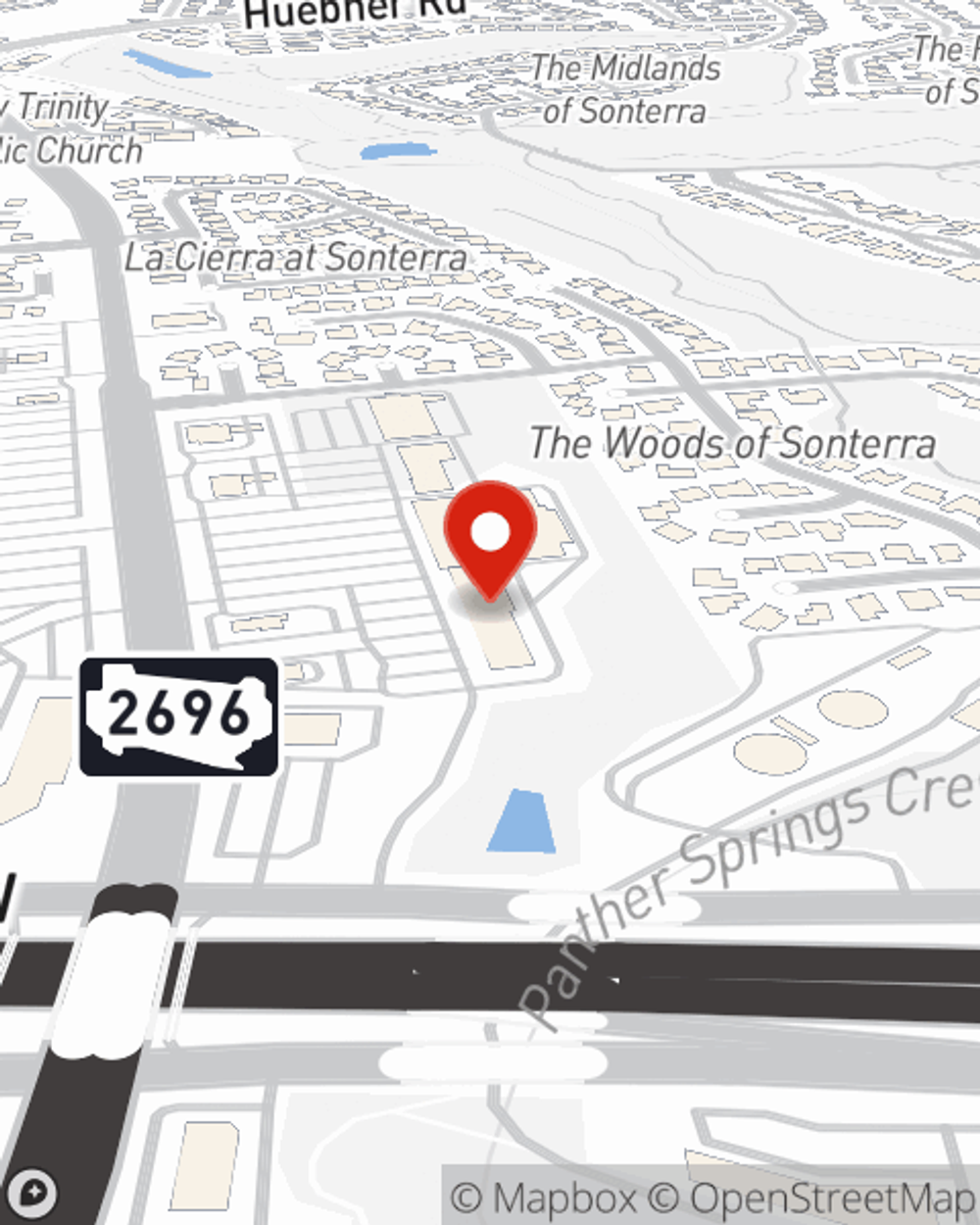

- Stone Oak

- San Antonio

- Bexar County

- Comal County

- Schertz

- Cibolo

- Bulverde

- Spring Branch

- New Braunfels

Home Is Where Your Heart Is

Your house isn't a home unless you're protected with State Farm's homeowners insurance. This exemplary, secure homeowners insurance will help you protect what you value most.

If walls could talk, San Antonio, they would tell you to get State Farm's homeowners insurance.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Safeguard Your Greatest Asset

State Farm's homeowners insurance safeguards your home and your possessions. Agent Brent Gilbert is here to help generate a plan with your specific needs in mind.

Your home is a big deal, but unfortunately, the unpredictable circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Brent Gilbert can help you put together the right home policy!

Have More Questions About Homeowners Insurance?

Call Brent at (210) 404-9777 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

Brent Gilbert

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.